Schedule a call

Sign up

FREE 30-MINUTE GROWTH STRATEGY SESSION

Complete this short application to see if I can guarantee growth for you and your real estate business

(OR I’LL GIVE YOUR MONEY BACK PLUS $1,000)

Change your life today

Join The Millionaire

Mentorship Ecosystem!

- Become a Deal Finder

- Learn how to Wholesale and Flip

- Build a Rental Empire & Scale

FAQS

Frequently Asked Questions

What is BRRR and how can I use it in Real Estate?

The whole premise is BRRR is like a reverse flip. You are finding an undervalued property, and either buying it at a discount and fixing it up, or you are buying it without fixing it up (even better) then you are renting it out, and refinancing it, and putting money in your pocket. The whole premise behind this is that it allows you to either recoup he money you put into the property or IDEALLY, you get more money than you have into the property, and then rent it out for a profit each month. So two things you do here, one you build capital, two you create cash flow. I always tell people that when you buy a rental property the minimum amount of cash flow is $500! The higher the mortgage payment, the more the cash flow should be, $500 is the bare minimum. Keep that in mind! Rather than flipping the property and selling it, you are BRRR Buy Renovate, Rent and Repeat, so that you are adding properties to your Monopoly board, this is how wealth is created buying long term property for passive income.

When should you pay a contractor?

Never pay a contractor up front! Think about that, does your boss pay you for work not completed. Contractors have a bad habit of asking for a percent of job upfront. Guess what you have just hired this guy as your money manager! Time and time again you will get burned. If they won’t work with you, kiss them goodbye. The solution that I use is to offer to pay for the materials and pay them weekly for a portion of the job that is complete. If they are not ok with that, them I am not ok with working with them. Always ask them to sign a contract! If you want a link to our contract (here it is)

How do you determine whether to flip, wholesale or hold a property?

Flipping and wholesaling are great for building capital. Capital is what you need for rental properties. If I could buy every property and keep it I would but you need cash sometimes for other things. My approach when determining what to do is quite simple. Lets say you buy a house to flip, and you are going to make $10,000 on it, but you will be able to airbnb it and cash flow 1k per month, or you can rent it out and make $500 per month, I would hold it as a rental because flipping for that small of profit is not going to do anything for you and you can make it up quickly in the short and long term rental routes. But lets say you are going to be able to make 30k or more on it, and that will allow you to buy another rental property that is going to make you $500 or more per month, then do that! I really like to make a minimum of 40k per flip or I try to hold them. 40k is a good number to make on a flip it may be to little or too much for you, but that’s my rule. I do that on cheap houses 100k or less and I try to make a lot more on the bigger flips. I have made $200k on one flip, it’s risk and reward, make sure you effort counts for something!

What is the best way to create longterm wealth?

So many people want to create wealth but they focus on immediate income which is highly taxable and also does not build wealth. Longterm wealth is built by buying properties for rentals long term. I always say you should plan on holding a property for at least 10 years! You can always get access to the equity by a cash out refinance if you need it, but if you keep it in the property that is a good idea too. I just got a call today 2-17-2023 from my business partner of 15 years, we bought a bunch of properties in Tacoma when we were first getting started together and we bought this one for 62k, we are going to sell it for 400k, we bought it when the market crashed and are selling it at close to the top of the market. Our strategy is not to pocket the cash but instead we are buying more cheap houses for cash in other markets like MS and KS and MO and FL. We can buy houses for under 100k so we should be able to pick up 4-5 houses for the sale. Guess what we well now turn the 1500 rent into 5k in rent and be much more diversified because of it! This is how you build wealth. We did the same thing three years ago when I first started investing in Kansas City. I said, hey Tacoma is red hot lets sell 4 houses, we turned those four houses into 22 houses! Now that 5k we were making in Tacoma is 18k, it took about two years to fix them up and rent them up, but now we have almost 4 times the rent coming in every month. Think about this, you start today and don’t focus on what will happen instead you keep just focusing on buying good deals and holding them for 10 years, and then stacking more income. You’ll be rich before you know it!

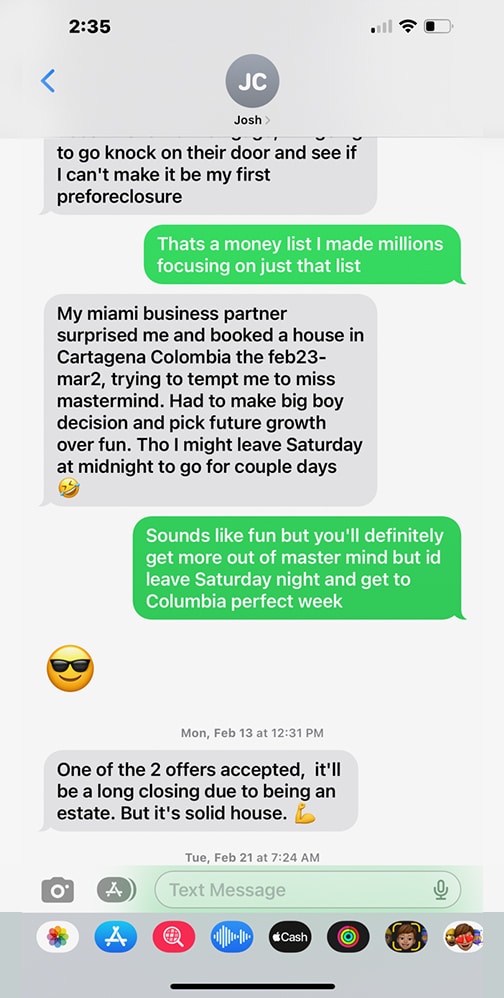

How do I find off market sellers?

Pick up the phone and call them! A couple of strategies here. 1. Find people in distress, foreclosures, behind on taxes, code enforcement liens, and other ways that people are feeling pressure. Then, pick up the phone and call them and offer to solve the problem that they are facing.

People think that everyone is motivated by price, the reality is that most people that sell good deals to me, have a problem. And yes again as I type this right now, I just got a call from my lender who knows I picked up a good property, and he said, I’ll buy it from you for 50k more than you paid. He knows I got a good deal and he knows I can sell it for 220-300k if I got and put a little money into it, so why did the seller accept my offer of 150k. The seller was a retired lady, she got caught up in scam with the neighbor and she wanted closure. She had it on the market before and she got duped by the guy next door and he tied her up in litigation. The house was well cared for, and she wanted 200k. I told her that I can’t pay her that, but I can pay her 145k. She said well thats too low and I said I know and you’re right it’s worth what you want, but I can not make any money doing that, and I buy houses for a good deal and a fair price, but if I buy at retail I can’t make any money that way. She said ok no problem. She was very nice. I said let me go look at it and I’ll give you my best offer. I looked at it, and the house was really a 2/1, the other houses she was talking about were 3/3’s and had garages. She knew her house was not as good, but it was clean, needed nothing. But she really wanted closure. I called her back and said I would close at 150k, but I’d close in two weeks, no inspections and she’d get the 150k, she said let me think it over and she did and then she gave me a call and said, she’d do it. We were both excited, I was excited to get a great deal and she was excited for closure and working with someone who wasn’t a liar and would close fast and end her nightmare. She’s up there and money is less important to her than me. She doesn’t have kids, and just wanted to pay off her condo. I listened to her, and gave her what she wanted, and did not try to convince that she was wrong about her value or this or that, I agreed but validated my risk and concerns. I told my lender about it, I was borrowing from him. He lives in the area and was looking to upgrade and he said would I sell it. I said I like the area for long term rentals, and he said I want it. I said make me a fair offer. He offered me 200k, and I said ok. I have not even closed on the loan yet. 50k profit for building relationships with him and her. It pays to be nice and honest, no one says you can’t make money.

Who do I wholesale properties, step by step?

1st, find an off market property (do not go after on market properties it’s too complicated and creates problems)

2nd find someone who is motivated, this is someone who has a reason to sell for a good price. You want to buy this property at 65-70% of market price minus the cost of repairs. In the industry we call this ARV, After Market Value, meaning after someone fixes it up, what will be the Market Price it will sell for.

3rd, find a buyer who will buy it for more than you have it under contract for. Good wholesalers leave meat on the bone for the flippers taking all the risk, bad wholesalers focus on netting the most possible profit and leaving NO money for the flipper and they don’t care and then they lose buyers because those buyer’s go out of business. The deeper you buy the better deal you can give to your buyer.

4th Assign and sell the contract, you are selling the rights to purchase the property

5th, close the deal and make the spread between what you got it into contract for and what you sell it to the end buyer for

How do you calculate the market value of a home?

It’s hard! In Vegas where I spent most of my career it’s very easy, everything is a subdivision, similar model and you just find something that is the same that sold and then you subtract or add the negatives and positives or your base it on the square footage and multiply the what the comparable listing sold for by the house square footage. In Vegas, I literally would find a house that sold for say $180 per square foot, and then if there was one in the same subdivision that was close to the same square footage and similar in look etc, just do the math. But lets say one has a two car and the other has a pool, and then one is on a busy street, and the other is one story. That is where you really need to analyze all the houses in the area and then, you SET your price. Market value is determined by the buyer. The buyer will decide how much they pay and then after that, the appraiser will say, hey yes, I agree based on the comps that that value is supported and if you base it off the comps it usually will appraise. Where it gets complicated is where you have HUGE differences. Lets say you are in Kansas City and all the houses are 5,000 sqft in the same area, and then you buy one that is 2,500 sqft, is it worth the same as the others? Or you do the reverse, you buy a 5,000 sqft house in an area that all the houses are 2-2500 sqft? The bigger the house the more you will lose! People budget by area not size of house. When it comes down to it, it’s school district (location) that sets the budget then how nice the community is within that area. Rich people don’t send their kids to bad schools. If you are just getting started, get a coach like me and I will help you comp the properties!

Should I get an LLC?

NO! Not until you find a deal! Too many people want to start with the LLC, just start finding deals, then get an LLC. An LLC takes like 3 minutes to set up. I used to use Lawyers, now there are websites that make it super easy. You just pick the state, select your filing status, Sole Proprietorship, General Partnership, LLC Scorp, Ccorp etc. We can go into that more, but basically, I suggest and LLC Scorp, in Wyoming or Delaware registered as a foreign LLC in your state!

What are 3 things I look at when checking out a property?

- Roof

- Sewer

- Mechanicals (plumbing, HVAC, electrical)

Everything else is cosmetic and is somewhat straightforward to fix!

How do you pay less taxes as a Real Estate Investor?

Hire a great CPA

Use depreciation and buy rentals!

Also always 1031 your rentals when you sell them to buy more houses for no tax.

Refinance vs. sell because refinances are tax free!

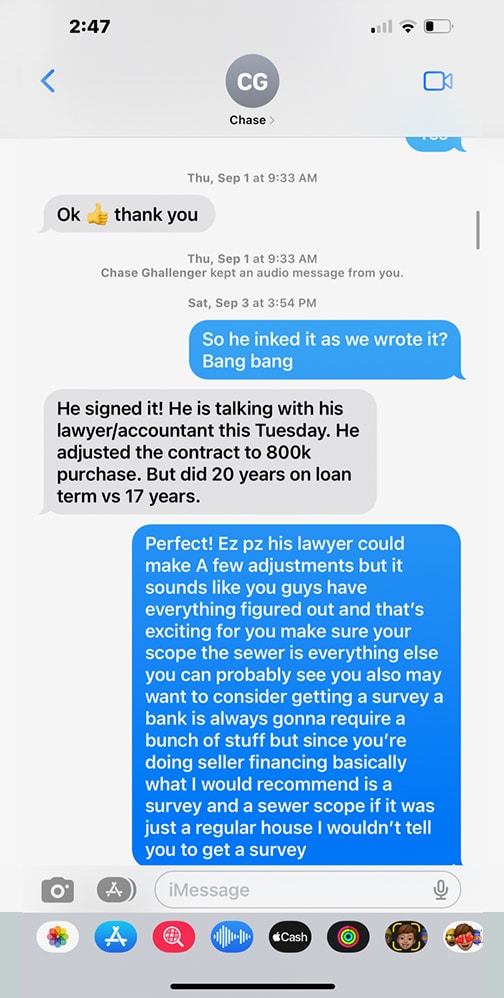

How does Creative Financing Work?

Get creative, the sky’s the limit. Most of the time when I do creative financing I do subject to’s. I buy a house, it’s in foreclosure. The seller is losing it. I catch up the mortgage, take over the loan, make the seller’s payment, Give them some cash, and then fix it up and sell it and pay of the seller’s mortgage after I am done. That is creative financing but some people call it subject To!

Why should I hire a coach/mentor?

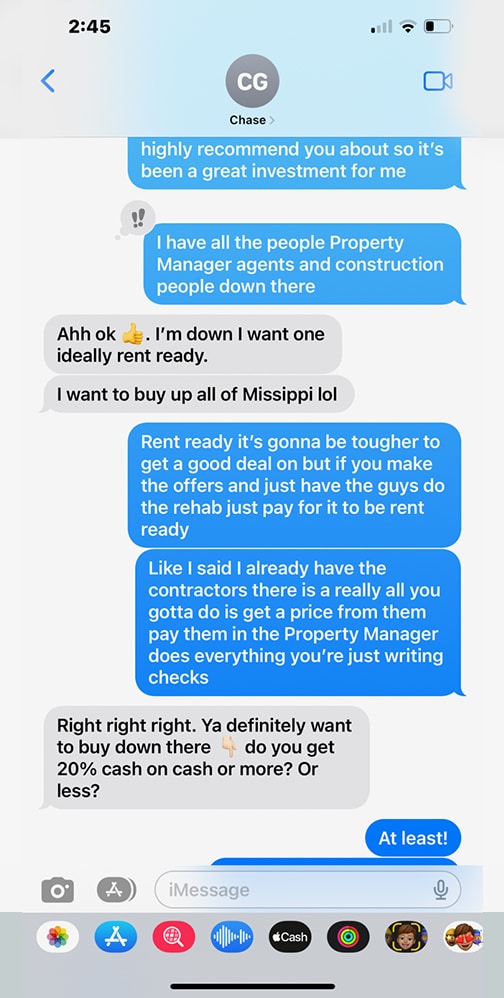

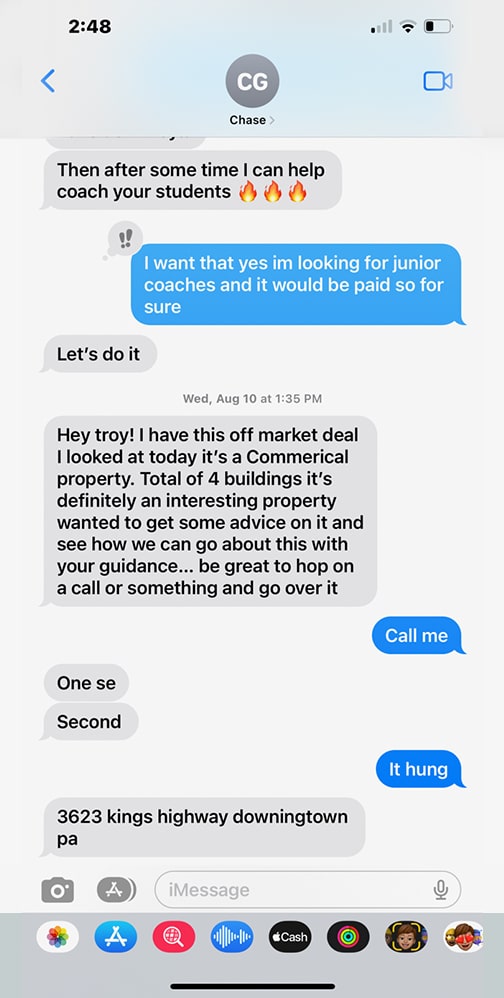

Lets face it, failure is the best teacher, but even parents help their kids learn how to walk. It takes the baby to get up and try again, but the rearing from they parent’s “coach” help manifest the ability to do it. Most people get a coach to avoid costly mistakes like losing money, or to get better at something and cut the learning curve. I used to not hire coaches, because we did not have such available resources when I started out. But I did have a mentor, it was informal, but it was someone I could go to for advice when I had questions. This helped me out at pivotal points in my life. There are good coaches and bad coaches, good mentors and bad mentors. What paid mentorship boils down to in our program is holding you accountable and helping you get where you want to go. Where you want to go is different than the other person, you want to get there, but you don’t know the right path, right direction or maybe you do, but you don’t know what landmines you are going to encounter along the way. Or, some of our students, we partner with, we help them find the deals and we keep them away from the ones that lose them money. Hire a coach if you want to accelerate your learning curve, and want someone to call when you run into a roadblock. When you want the cheat code for success, hire a mentor!

How do I get started with NO MONEY?

If you have no MONEY, you need to get educated! Then you need to get money, you need to learn how to save! Do you have a spending problem? Regardless of how much money you make, if you can’t keep it, you will never be able to keep it! Become a saver. In order to get to the next level in life you NEED TO PAY YOURSELF FIRST, lots of people have the ability to make money, but keeping it is the name of the game. I learned this very early on and I always knew how to save my money. What do you need, and what do you want? If you have a new car, nice clothes and no money, who are you fooling? Not you, because you know that you are broke and guess what, keep spending more than you make and you always will be that way. Do you like to go out to eat often, and you are broke? You are a product of what you do. My recommendation is you build a habit of paying yourself 20% of whatever you take in, no matter what. Do that before you start with anything else. Then once you do that, learn how to generate income. If you are broke starting in Real Estate start as a deal finder, learn how to Wholesale or work for someone that can teach you the game. I have two folks right now that work with me, they get paid and they learn what they want to. They are buying stuff now and soon they will work for someone else and soon they will know exactly what to do and they won’t need me. You work a job for knowledge first and money second? Money is great but what if you don’t know how to make money, then you will always work for it, vs. it working for you!

How do I scale?

YOU NEED MORE MONEY! Are you doing everything yourself? I have been there! What is the job that you are doing that is A. Replaceable B. You don’t like doing it C. Is the least effective use of your time. I still talk to seller’s! Why, I make big bucks talking to seller’s. But I hate answering emails. Should I spend my time talking to seller’s or answering emails. People always say, hey Troy, did you get my email? NO… I don’t read them, if it’s important call me. IF it’s not, email me or text me, and I’ll get to when I can. Any time I check emails or text, I lose time and money. I need to be working on things that make me money, and you are trying to scale, what can you let go of. You need to be getting access to lenders, seller’s and finding a way to build systems and processes vs. working in the business. No one is perfect but working towards getting better at it each day is the way you make it better. We are all constantly improving, or are we? I gravitate towards doing what is easiest and I am sure that you do too. I do not want to spend hours writing these FAQ’s but it has to be me, it’s my program, my voice and my answers and I have to do it once. Now, if you are scaling you might also need to get a Property Manager, but they may not care about it as much as you, so maybe you need to hire an inside property manager, someone who works just for you. Can you advertise vs. cold calling? Can you Send SMS vs. texting everyone? Can you hire out what you are doing and buy your time back vs. doing it yourself!

How do I create passive income?

Passive income is income made without having to go out and work for it. The definition is moreso a tax term, referring to active income and passive income. Active income is taxed at a higher rate than passive income. People want passive income for two reasons, one it’s passive meaning it’s taxed at a lower rate, and two, if you do it right it’s passive in nature meaning that you don’t have to work at it. To obtain truly passive income in Real Estate you have to scale.

What is the definition of wealth, and why do I want to be wealthy?

When I first heard this definition it made a lot of sense to me, and now I don’t even think about it, but if you’re NEW it may take you a few minutes to soak this up. The definition of wealth is paying all your bills, and growing your money without having to work. That’s through passive income. So lets say your NUT (amount of money you have to make is 5k per month) to pay all your bills, and you have a job and that pays your NUT and gives you some spending money. Well, when you buy Passive Income, rentals, and they produce 5k, that is covering your NUT, but when it’s at $1 dollar more you are building wealth (not really, but theoretically), really it’s more like, once you have say $1,000 more in income from your passive income, you’re building wealth. Once you are not relying on your savings, you’re building wealth. For instance, if you have a savings account, and have $10,000 and you have a NUT of $5k per month, you’re out of money in two months, vs if you have that passive income of $6k, not only are you paying your bills but your adding money to your savings every month. As you add onto your passive income you build more wealth. For me, when I really felt wealthy was when I had enough cash flow $40k at the time, to buy another house each month! I call that the snowball effect, you’re gobbling up a house every month from your passive income, multiplying your wealth, and then it continues…. That’s why the rich get richer!

How do I scale in Real Estate?

This is my version, there are many different ways that people will tell you how to scale, but I play it like they taught us to play monopoly. You start with becoming a deal finder. The key to being a successful real estate investor no matter where you are at in your journey is knowing what a good deal looks like, whether that’s a cheap house, large apartment wholesale deal, flip, etc. You MAKE YOUR MONEY ON THE BUY! Repeat that, you do not make your money when you sell, you make your money when you buy the property, so buy it deep and buy it right.

1st, become a deal finder, learn how to find deals. Finding deals leads you to being able to wholesale (if you need to build capital) or partner with people who have money and flip those properties. Flipping doesn’t mean rehabbing if you find a good deal, you can simply list it on the MLS (with or without a Realtor) and wholetail it. Buying deals right means buying them below market value before you improve it.

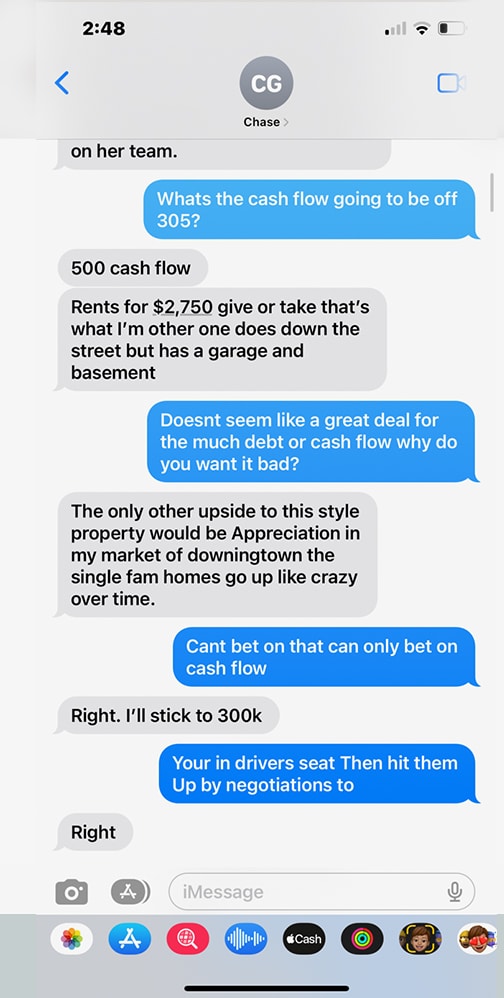

2nd once you become a deal finder, you have to do a few things, do more deals, to make more money, and buy rentals to offset your gains, and reduce your tax liability. This is usually the first step for most people to gain wealth. As wholesale or do flips you get high income, that high income needs to be invested into rental properties. You take your same approach as a deal finder, and you BRRR out your capital (tax free) and rent our your properties. That way, you build capital and passive income. The minimum passive income you need to get per property is $500 per house. And that number goes up the more expensive the house is. Keep in mind that the larger the loan, the harder it is to recoup that money so that is not a hard and fast rule, but it’s based on the loan amount, again the more the cash flow the easier it is to build wealth and protect your self. Rent it fast and don’t chase the market.

3rd as you begin to do this repeatable process you will learn that you won’t be able to really eliminate or high reduce your taxes until you really get into the larger commercial or higher price points. Lets use 500k as a high price point benchmark. When you start leveraging, using financing on larger debt, this is where you get your best tax savings. We do this through cost segregation or accelerated depreciation. This allows you to keep more of what you make and improve your wealth while flipping wholesaling, and buying rentals for passive income.

How do I get knowledge?

Knowledge is great and confusing, sometimes the more knowledge you have it makes it harder to know what direction to have. Sometimes the people that have the most knowledge make the least progress because they are encumbered with knowledge. Knowledge is learned from doing deals and the only way to get applicable knowledge is to do deals

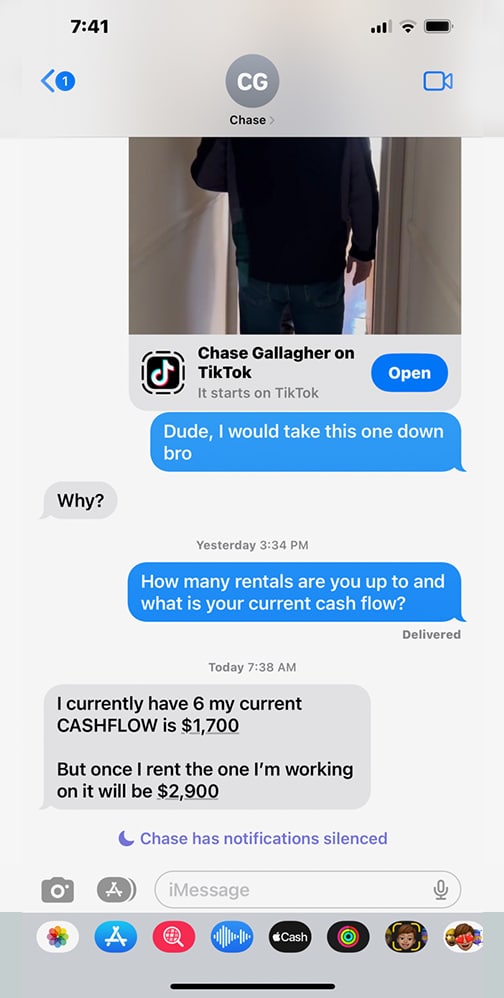

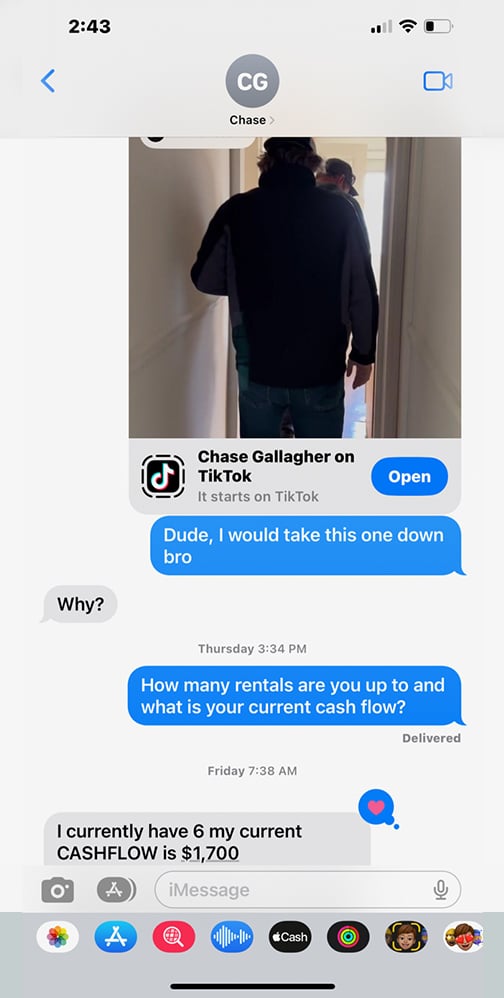

How do I create cash flow?

Too many people focus on networth. You have have car worth 200k, a stock portfolio worth a million dollars, and no cash flow and be broke! Why, you have no cash flow. Cash flow is the lifeblood of business and real estate, it’s why Real Estate is so powerful because the more that you own that creates cash flow the more you can buy that creates cash flow. Cash Flow means, revenue is more than expenses, that’s what cash flow means. You have a house, the cost of the ownership is “debt” “taxes” “insurance” “maintenance” and the rent is X. The lower the expenses, the higher the rent, the higher the cash flow. Reduce expenses and control cash flow.

How do I invest in Real Estate when I don’t have any money?

Refer to finding deals. People who know real estate know that if you focus on finding deals the money will come. We partner with our students. So if you join our program and you have the money to invest in yourself, we can assist you in making the big bucks. But, if you just want to get started on your own, wholesaling can be done with little or no money! Or become a bird dog. We love bird dogs, find a deal, connect an investor like me with it, and ask to be paid for the deal. No contracts, no dealing with deals, just learning how to identify off market properties and sellers. Wholesaling teaches you the whole kitten caboodle! But I can tell you I have bought countless properties with no money down and sometimes even got paid at closing. It’s not often, it’s not common, but it happens when you are looking for it, and know what to look for!

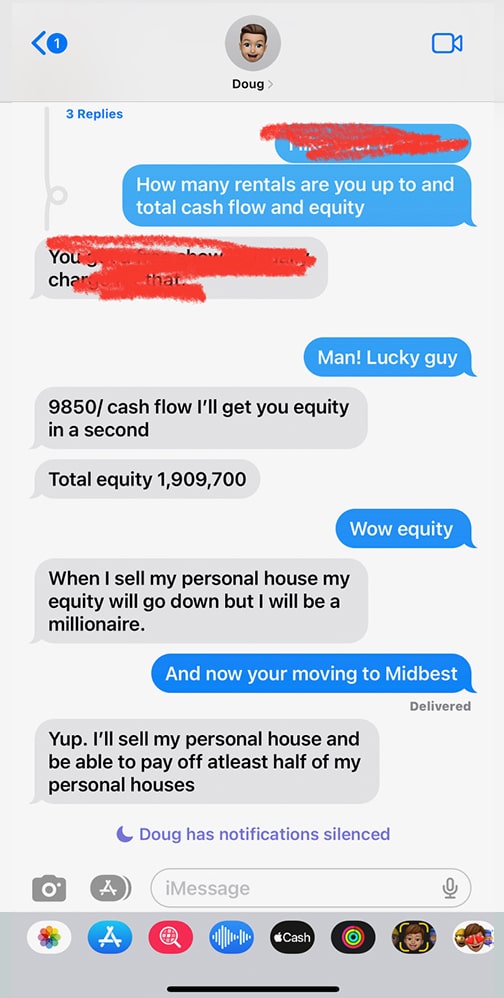

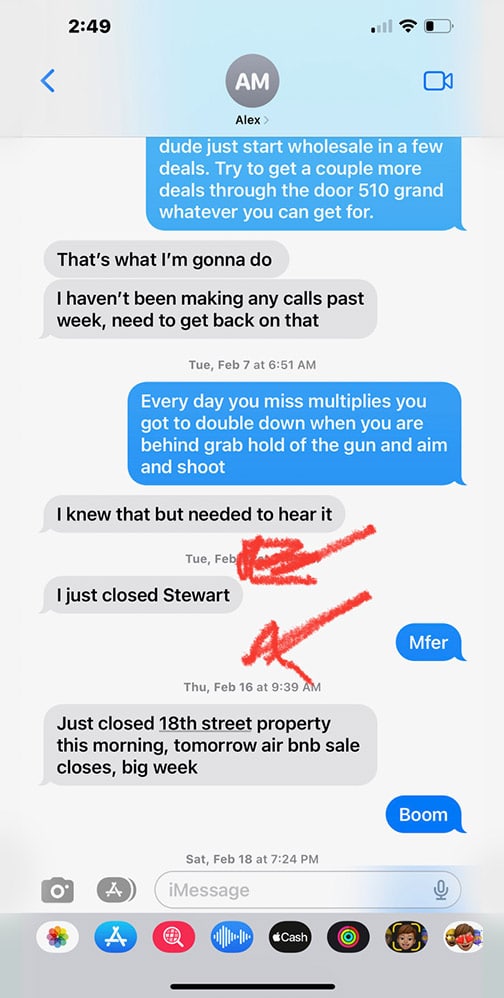

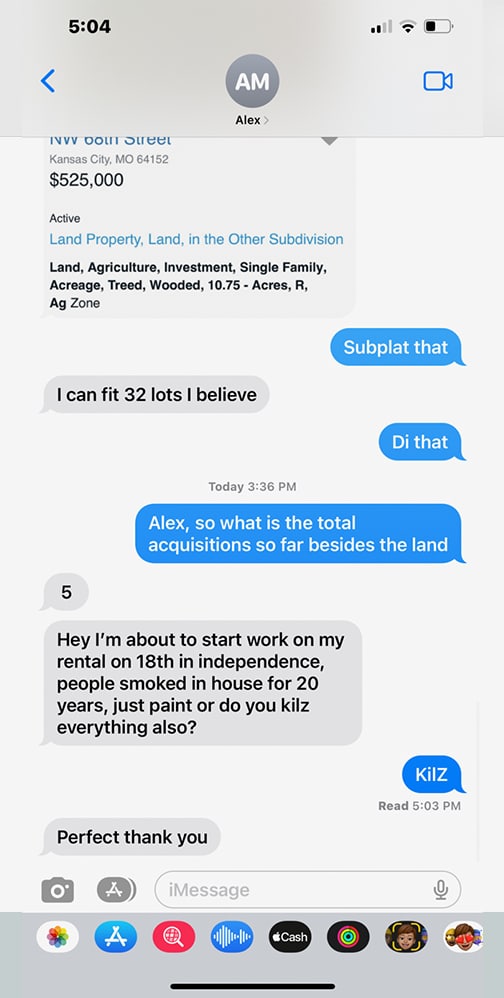

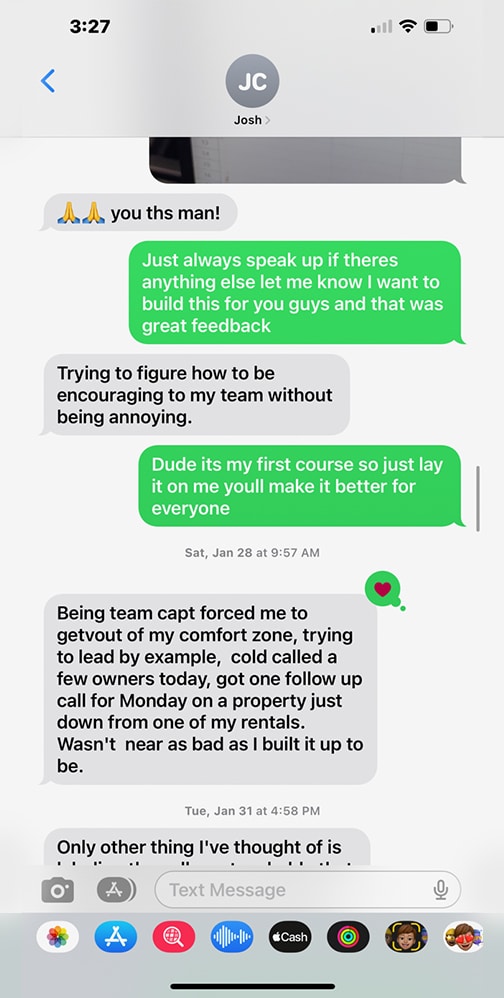

Testimonials